Empowering the Future of Industrial Real Estate

Founded in 2012, Faropoint is a U.S.-based real estate investment firm focused on last-mile industrial assets in high-demand urban markets.

About Faropoint

Our Approach

Our vertically integrated platform combines local teams operating across high-barrier markets with proprietary technology that accelerates underwriting and identifies opportunities. This end-to-end control from deal sourcing and acquisition through asset management and disposition enables disciplined execution designed to support strong, risk-adjusted performance over time.

Our Investment Strategy

We target last-mile industrial assets in supply-constrained urban markets where limited land and proximity to consumers drive sustained demand. Across our fund strategies, we execute on individual assets, portfolio acquisitions, and opportunities ranging from stabilized core-plus to value-add, focusing on properties between 20K-100K SF in high-barrier locations.

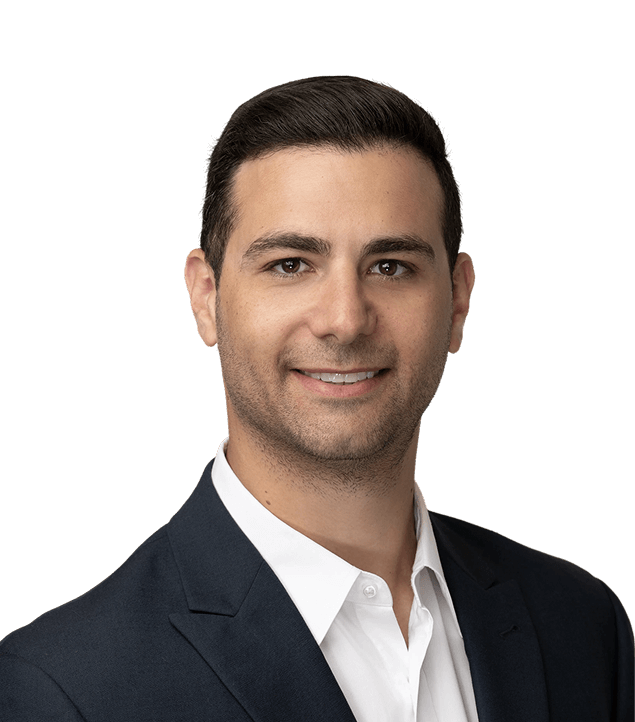

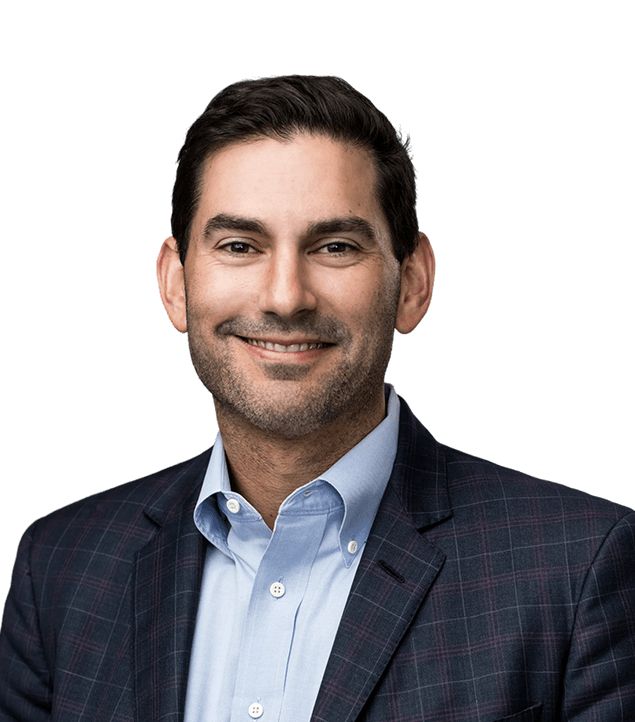

People Behind Faropoint

We’re hiring!

Latest Insights and Updates

Faropoint, a real estate investment firm focused on last-mile industrial properties in high-population- growth markets, has received $273 million of financing proceeds from a bank syndicate

Faropoint, a tech-enabled real estate investment firm focused on last-mile industrial properties in high population-growth markets

Two-building Joyce Kilmer Logistics Center will comprise 195K square feet

Local teams.

Proprietary technology.

Relentless Execution.

.png)

.png)